| |

ACCOUNTING FOR CASH

Each store operator is responsible for the cash

collected from sales as long as it is in his or her

possession. Cash is usually collected at the close

of each business day by the ship’s store officer

or a designated collection agent. Two records are

maintained in which the cash collection is

recorded. In addition to these records, ROM users

will enter cash collections in the cash receipt

function daily, or as soon as practical.

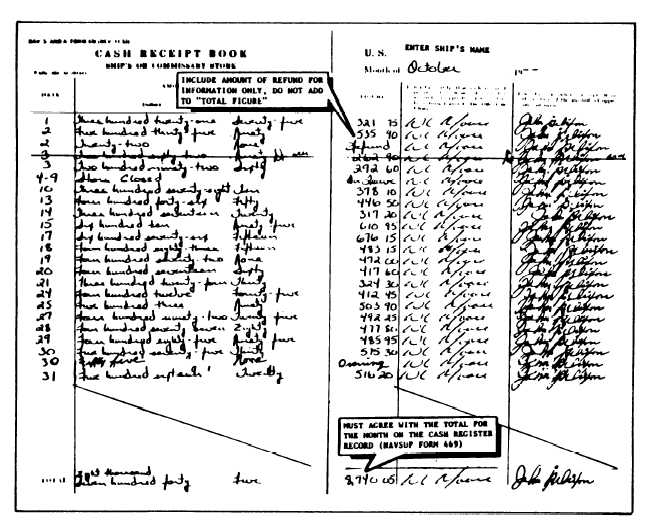

Cash Receipt Book

The Cash Receipt Book, NAVSUP Form 470,

has already been mentioned often in this chapter.

The NAVSUP Form 470 shows receipt for all cash

and overring or refund vouchers, if any, turned

in to the ship’s store officer or cash collection

agent. This cash receipt book is kept in the

custody of each sales outlet operator. The

designated cash collection agent, when making the

daily collections from the sales outlets, must

receipt for all cash in the cash receipt book. (See

fig. 2-9.) When the cash collection agent is making

collections, the ship’s store officer will review the

cash receipt book daily, or at least twice a week,

and will initial entries. In addition, the ship’s store

officer will compare the amounts entered on the

ROM with the amounts entered in the NAVSUP

Form 470 once a week. Spaces are provided in

the cash receipt book for the date; the amount

of cash turned in (which is written out in words

and also entered in figures); and the signature of

the person collecting, as well as that of the sales

outlet operator. Whenever an error is made, draw

a line through the entire line and write the correct

information in the following space. Line-outs

must be initialed by the sales outlet operator and

the person making collections. No alterations are

allowed.

Whenever the store is closed for 72 hours or

more, record it in the cash receipt book. Record

Figure 2-9.—Cash Receipt Book, NAVSUP Form 470.

2-22

|