| |

ways in which this important element of the accounting

classification code is used.

UNIT IDENTIFICATION CODES

The UIC is a five-digit number that identifies an

entity in the Department of the Navy or Department of

Defense. Every command has a UIC. In fact, UICs are

also assigned to civilian contractors and others who do

business with the Department of Defense. Besides

being used in the accounting classification code, as we

mentioned earlier, UICs also appear in the Paid By

section of public vouchers to aid in the identification of

the disbursing officer of the agency making payments.

UICs are also used in the Joint Uniform Military Pay

System (JUMPS) for such things as the distribution of

leave and earnings statements (LESs) and identification

of the responsible paying offices for pay and

allowances. The complete listing of Navy UICs can be

found in the Navy Comptroller Manual (NAVCOMPT

Manual). Volume 2, chapter 5.

INTERNATIONAL BALANCE OF

PAYMENTS

The identification of financial transactions

involving other countries is important to the United

States Government. The economic well-being of the

United States is directly influenced by the international

balance of payments (BOP). The Comptroller of the

Navy is responsible for coordinating and developing

policies and procedures regarding foreign currency

exchanges and other international financial transactions

involving the Department of the Navy. The comptroller

establishes procedures for the use of foreign currency

in those countries in which the United States has Status

of Forces Agreements (SOFAs), NATO Agreements, or

Base Rights Agreements. Favored nation exchange

rates for official transactions and for accommodation

exchanges for United States personnel are sought by the

comptroller as well.

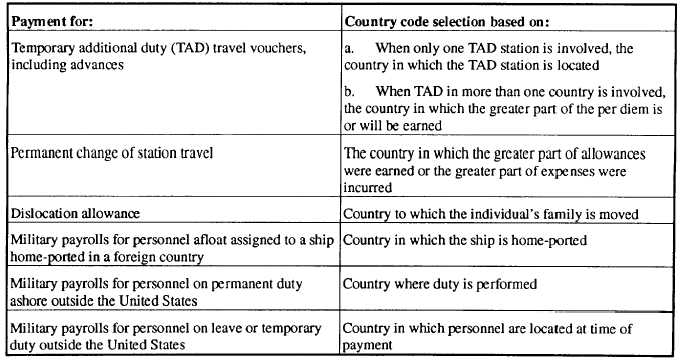

Any transaction that affects the international BOP

must carry a two-character alpha code identifying the

country involved in the transaction. An example is CA

for Canada. Chapter 7 of the NAVCOMPT Manual,

Volume 2, contains the assigned country codes and the

rules for applying them. Some general rules are shown

in table 2-1.

Remember, you can find additional information

about the rules for selecting and applying country codes

in chapter 7 of Volume 2 of the NAVCOMPT Manual.

As well as the required country codes, you must

also be aware of any applicable expenditure or

collection category codes. In fact, any voucher that

requires a country code must also have either a

three-digit expenditure category code for

disbursements or a two-digit source code for

collections. These codes apply to transactions affecting

disbursements and collections involving any

appropriation, including all general, revolving, deposit,

special, or trust funds, as well as any general fund

Table 2-1.-General Rules for Country Coding Selected Transactions

2-8

|