| |

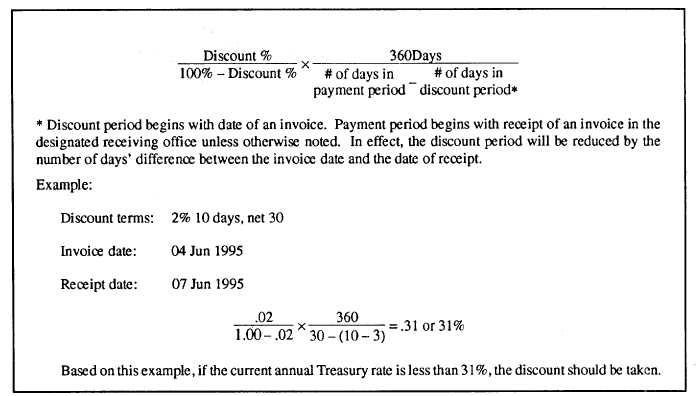

Figure 6-2.—Computation of annual percentrages for discounts.

activities must make every feasible effort to expedite

paying office is charged with the responsibility for any

the processing of all invoices offering discounts.

Unfortunately, however, discounts are sometimes

lost. Whenever a discount is lost, whether intentionally

or unintentionally, the paying officer should pay the bill

in the normal manner when paying other bills not

offering discounts. Each DO is required to maintain a

record of discounts that were required to be taken but

were lost because the disbursing office failed to process

the bill within the allowed time frame. The record

should contain all mandatory discounts that were lost,

regardless of whether the purchase or service contracts

called for the discounts. The record will identify each

invoice and the activity responsible for losing the

discount on that invoice.

Since the discount period begins with the

contractor’s invoice date, the Navy will be unable to

take a discount in some instances because of

circumstances beyond its control. An example of this

would be a discounted invoice that was received after

the discount period had already expired. A record of

this type of lost discount will also be maintained.

Except for paying offices and those instances

mentioned in the previous paragraph, the activity in

possession of the dealer’s bill on the date the discount

expires is considered responsible for the loss. The

lost discounts from dealers’ bills in its possession on the

date the discounts expired under the following

conditions:

The dealer’s bill offers a discount greater than

$15 but less than $500 and was received at least

3 working days before the expiration of the

discount period.

The dealer’s bill offers a discount greater than

$500 but less than $1,000 and was received 2

working days before the expiration of the

discount period.

The dealer’s bill offers a discount of $1,000 or

more and was received 1 working day before the

expiration of the discount period.

Any activity that receives a dealer’s bill offering a

discount and fails to process the bill for payment within

one-third of the discount period is charged with

responsibility for the loss of the discount. The only

exceptions are when the paying office can prove the

following circumstances:

1. The dealer’s bill was not delivered in time for

the paying office to meet the payment

requirements previously described.

6-7

|