| |

original accepted and certified bid is retained by the DO

to prove the place of purchase in the event that some of

the currency is later sold through commercial channels.

REVALUATION OF FOREIGN

CURRENCY

We mentioned how the rate of exchange of some

foreign currencies is set by official agreement. Any

change in the official or agreed upon rate of exchange

will result in again or loss by revaluation. Revaluation

is a change in the U.S. dollar value of the foreign

currency.

You should understand the revaluation process

because the rates of nearly all major foreign currencies

fluctuate frequently as a result of changing market

conditions. You should also understand the accounting

procedures a DO must use for revaluation of foreign

currency when the rate of exchange is backed by an

official agreement between the United States and the

specific foreign government and when it is not. Let’s

first look at the procedures the DO must use in the case

of an official change in a fixed legal rate of exchange.

OFFICIAL RATES OF EXCHANGE

Upon receiving a notification of a change in

valuation because of an official government action, the

DO should immediately make the change in his or her

account.

If possible, the DO should make the

revaluation of the foreign currency on hand at the

beginning of the business day in which the change in

the prevailing rate occurs.

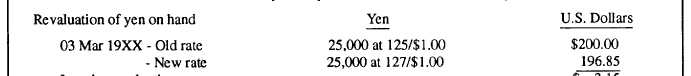

In revaluating the foreign currency, the DO first

determines the new U.S. dollar value by dividing the

total foreign currency on hand by the new exchange

rate. The DO then compares the dollar value at the old

rate with the dollar value at the new rate and determines

whether a gain or a loss has occurred.

Gains and Losses

Because all foreign currency is carried in the DO’s

account at the U.S. dollar value, the DO must adjust this

account by the value of the gain or loss resulting from

the revaluation. The DO does this by recording the gain

or loss by revaluation as a transaction in the account.

Documentation

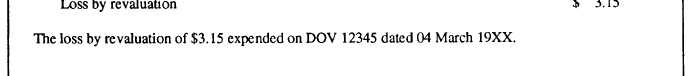

The DO must prepare and sign a Certificate of

Revaluation, similar to the one shown in figure 5-2.

This certificate will be attached as a supporting

document to the DD 1131 or SF 1034, which the DO

must also prepare to account for the gain or loss by

revaluation. The DO must record the gain or loss as a

Figure 5-2.—Certificate of Revaluation due to change in prevailing rate.

5-5

|