| |

The two reports discussed previously are the

primary reports needed to reconcile with the

memoram.lum accounting logbook.

All claims and

corresponding amounts presently in the accounting

system can be verified using them. If the claim is not

shown as being recorded on one report, it must be shown

on the other report or else it will not have been recorded

in the system. Reconciliations means, therefore, that

starting with one report, you go through it comparing its

entries to the entries in the memorandum accounting

logbook. If you do not find a voucher on one report, you

should then go to the other report. If it is not on this

report, it is not in the accounting system and you should

note this fact. Repeat this process until all vouchers

recorded in the accounting system arc reconciled against

the memorandum accounting logbook. Besides

verifying that all the vouchers have been recorded in the

accounting system, you should also note the following

items:

l

l

Accounts recorded in the accounting system that

are incorrect—both obligations and expenditures

Canceled vouchers or vouchers improperly

charged against a job order that are recorded in

the accounting system-both obligations and

expenditures

Report all errors to the appropriate person at your

accounting activity.

NOTE: If you have access to an Integrated

Disbursing and Accounting System terminal, you will

be able to directly enter the obligations yourself. This

should make reconciliation easier especially if you enter

them in a timely manner.

You may also receive a weekly transaction listing.

Although this enables a weekly reconcilitition, a

monthly reconciliation is adequate—except at the end

of the fiscal year when it is critical that fund status be

closely monitored.

The key to effective accounting is a good

relationship with the AAA—keep the lines of

communication open and whenever a problem arises

consult with them. Try to cooperate with them and keep

them informed. It is not always easy but it is worthwhile

to make an effort to adjust and establish appropriate

procedures.

Of course make allowances for

geographical separation and the fact that you are not the

only command served by the AAA.

UNLIQUIDATED OBLIGATIONS

You are not done managing Navy claims funds until

all obligations have been liquidated. This means that

you must establish procedures to review the status of

unliquidated obligations. There also exists a category

called unmatched disbursements that must be reviewed.

Unmatched disbursements are expenditures against

your authorization that have no corresponding

obligation. You are required to prepare an annual report

on your review of outstanding unliquidated obligations.

MEMORANDUM ACCOUNTING

LOGBOOK

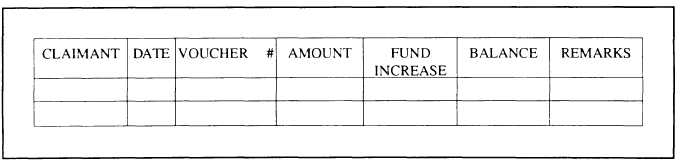

A sample format for the memorandum accounting

logbook is shown in figure 12-10.

While funds are not authorized by type of claim,

JAG recommends that you internally allocate specific

amounts for each type of claim up to the amount of your

authorization if you pay more than one type of claim.

You should then enter this amount in the memorandum

accounting logbook and adjust internally as needed. To

facilitate reconciliation, number vouchers

consecutively by job order as they are prepared. Use

this number in the last four positions of the Navy

standard document number assigned to the voucher. If

a claimant is due additional funds (for example, a

reconsideration), prepare a new voucher assigned the

next consecutive voucher number to the voucher. If you

do not enter the obligations yourself and vouchers are

Figure 12-10.—Sample format for memorandum accounting logbook page.

12-40

|