| |

Block 12: The accepting clerk stamps with an APDS

the “Mailing Office Date Stamp” block of Copy 3.

NOTE: Copy 4 of PS form 2976-A is detached by the

accepting clerk and maintained at the post office for 30

days.

ATTACHING CUSTOMS DECLARATIONS

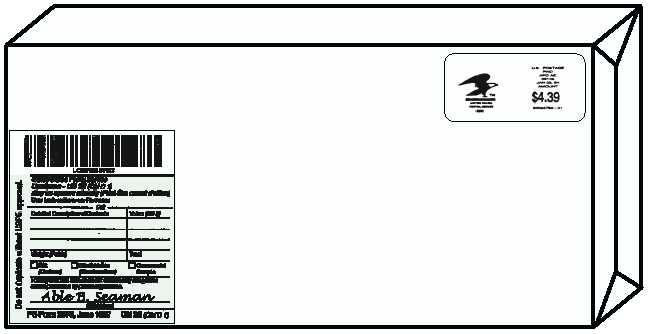

Space permitting, all customs forms must be

placed on the address side of the article, preferably to

the bottom left-hand side. See figure 4-14. PS Form

2976 has a self-adhesive backing.

Remove the

protective covering before affixing.

After the clerk dates copy 3 and detaches copy 4 of

the PS Form 2976-A, the form set is returned to the

customer.

The customer must place the form set

(copies 1, 2, and 3) into the envelope (PS Form 2976-E)

and affix the envelope to the package. PS Form 2976-E

is a clear plastic envelope with a peel-and-seal flap.

BONA FIDE GIFTS

Military and civilian personnel who are authorized

to use the Military Postal Service located outside the

CTUS, may send duty-free, unsolicited gifts through

the mail to addressees in the U.S. provided that:

The gift does not exceed $100 in value ($200

when sent from Guam, American Samoa, and

the Virgin Islands).

The recipient does not receive more than one

such shipment on the same day.

Gifts that

exceed this retail value limitation will be subject

to payment of duty, on the entire value of the

shipment, by the person receiving the gift. A

person mailing a gift may NOT pay the duty in

advance.

Gifts that are intended for several people may be

sent inside one parcel, to a single addressee, provided

that:

Each individual gift is wrapped and bears the name and

address of the recipient, and is endorsed

“UNSOLICITED GIFT.”

The outer parcel, containing the multiple gifts, is

endorsed on the address side to show the number of

individual gifts enclosed and value information. For

example, a parcel containing 3 individual gift parcels,

for separate individuals, would be endorsed “THREE

UNSOLICITED GIFTS ENCLOSED.

NO ONE

INDIVIDUAL RECEIVING GIFTS EXCEEDING

$100 IN VALUE” or similar wording.

AMERICAN GOODS RETURNED

Articles that are grown, produced, or

manufactured in the U.S. and which, after having been

exported, have not increased in value or improved in

condition, may be mailed back to the U.S. free from

customs duty. However, a properly completed customs

declaration shall be attached to the address side of the

4-21

PCf0414

Able B. Seaman

USS Underway (CV-66)

FPO AE 09561-0001

Mr. Jack Frost

5 Sunnyside St.

Anytown US 11111

SAM

1 pair of leather shoes

65.00

65.00

4 lbs 3 oz

X

Figure 4-14—Parcel depicting placement of customs form.

|