| |

have been avoided if the customs declaration was more

closely checked by the accepting clerk. Some of the

most common errors are as follows:

Mailing of used personal effects without

indicating so on the customs form.

Failure to indicate that the merchandise is of

U.S. origin.

Failure to indicate that the material was taken

overseas after having previously been in the

owner’s possession in the U.S.

Proper completion of customs declaration forms

will also ensure that parcels move through customs

with a minimum of delay.

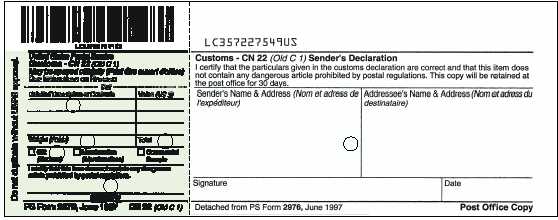

PS Form 2976

The following instructions, explain how to

properly complete PS Form 2976 (see figure 4-12).

Block 1: Sender enters a detailed description of the

contents. This includes quantity, material an article is

made of such as cotton, leather, silk, etc., brand names,

and whether the article(s) are new or used.

Block 2: The sender enters the dollar value of each

article and totals it.

Block 3: The accepting clerk enters the weight of the

article expressed in pounds and ounces.

Block 4: The sender marks with an “X” to indicate the

type of contents.

Block 5: The sender signs the customs declaration

form.

Block 6: The sender enters their name and address, the

name and address of the addressee, then signs and dates.

NOTE: The MPO maintains the detached PS Form

2976 at the post office for 30 days.

PS Form 2976-A

The following instructions are to be used to

properly complete PS Form 2976-A (see figure 4-13).

Block 1: Sender enters name and address, just as they

appear on the article being mailed.

Block 2:

Sender enters the addressee’s name and

address, just as they appear on the article being mailed.

Block 3: Sender enters a detailed description of the

contents (model, make, brand names, new or used, and

country of manufacture). The sender must also include

the quantity and value for each item. Enter the net

weight of each item, if known.

Block 4: Sender marks with an “X” to indicate the type

of content.

Block 5: Sender marks with an “X” to indicate proper

disposition in case the article is undeliverable.

Block 6:

Sender signs and dates the customs

declaration.

Block 7: Accepting clerk completes this block only

when numbered insurance service is requested. Enter

the insured number from the customer’s receipt.

Block 8: Accepting clerk completes this block only

when insurance service is requested. Enter the insured

dollar amount.

Block 9: Leave the “SDR Insured Value” block blank.

Block 10: Accepting clerk enters only the postage, no

fees.

Block 11: Accepting clerk enters the article’s weight

expressed in pounds and ounces.

4-19

PCf0412

1

2

5

6

4

3

Figure 4-12—PS Form 2976, Customs - CN22.

|