| |

CHAPTER 2

APPROPRIATION ACCOUNTING

Appropriations are broad categories or blocks of

funds authorized by Congress to be used for specific

purposes by various government departments. Because

appropriations are made for specific purposes and

cannot be expended for other purposes, accounting for

appropriations is an essential part of the Navy’s

financial management system. In fact, it is the

appropriations authorized by Congress to be made from

the general fund that support the Navy’s operations and

strategic capability.

The purpose of this chapter is to examine the

various components of appropriation accounting. As a

senior Disbursing Clerk (DK), you will become directly

involved in this area of responsibility because you will

be required to report all disbursements and collections

accurately by the appropriation itself and by the various

components of the accounting data. The information in

this chapter is designed to provide you with an overview

of these responsibilities and procedures. After studying

this chapter, you should be able to describe the

components of appropriation accounting and their

individual and collective roles in the Navy’s financial

management system.

NAVY FINANCIAL

MANAGEMENT

Before discussing the components of the

appropriations and the related accounting data, let’s

take a look at some basic aspects of the Navy’s financial

management system, such as the fiscal year and the

Five-Year Defense Program (FYDP).

FISCAL YEAR

The fiscal year for the federal government begins

on 1 October of each calendar year and runs through 30

September of the following calendar year. The fiscal

year is designated by the calendar year in which it ends.

For example, the fiscal year for 1997 will begin on 1

October 1996 and will end on 30 September 1997.

Although the time frame for a fiscal year is the 12

months from 1 October of one calendar year through 30

September of the following calendar year, the

operational scope of the fiscal year is much broader.

During a fiscal year, several different transactions will

take place. Some of these transactions will be related

to the current fiscal year. Others, however, will be

related to the previous fiscal year. In fact, some will

even concern future fiscal years. This means that while

transactions for the current fiscal year are being

processed, appropriations for previous fiscal years are

still being cleared or settled. Simultaneously, the

planning and development of budgets for future fiscal

years may also be taking place. This is why you, as a

senior DK, must be aware of all transactions associated

with budgeting, appropriation accounting, and the

significance of the fiscal year. The dimensions of the

Navy budget are indeed broad for any one fiscal year.

This is one of the reasons that the Department of

Defense instituted the FYDP.

THE FIVE-YEAR DEFENSE PROGRAM

The FYDP establishes the planned force structure

and financial levels for the military departments for a

5-year period. To allow for the making of careful

decisions, the FYDP provides a method by which the

information the military departments will use for

planning, programming, and execution can be

accumulated, grouped, and controlled according to

specific meaningful categories called programs. At the

time this training manual (TRAMAN) was published,

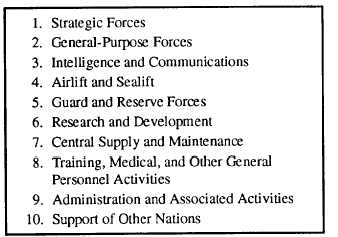

the FYDP consisted of the 10 programs shown in figure

2-1. These 10 programs provide a framework from

which the Navy develops its annual budget requests.

Figure 2-1.-Ten programs used in the Five-Year Defense

Program.

2-1

|