| |

DRAWN ON A FOREIGN BANK/PAYABLE

IN U.S. DOLLARS THROUGH A FOREIGN

BANK.— The DO endorses these instruments and

completes a single SF 215 for the total amount, leaving

Block 2 blank. (Block 2, Date Presented or Mailed to

the Bank, will be completed by the bank.) The DO

mails the endorsed instruments and the SF 215 to the

Citibank, Global Check Clearing Collections, Hyde

Park, New York. Upon receipt, Citibank completes

Block 2 of the SF 215 and immediate y credits the total

amount to the Treasury account. Citibank then returns

a confirmed copy of the SF 215 to the DO.

NOTE: It may take several weeks for Citibank to

collect the proceeds of these instruments. If Citibank

determines that the shipment contains uncollectible

instruments or assesses collection charges (also called

lifting fees), the DO may later receive an SF 5515. We

discuss these fees in a subsequent paragraph.

DRAWN ON A FOREIGN BANK/PAYABLE

IN FOREIGN CURRENCY.— The DO must also

endorse and forward these instruments to Citibank, but

the deposit procedure is different. A separate SF 215 is

required for each foreign currency instrument. (Again

Block 2 of the SF 215 is left blank. Also, Block 4,

Amount, is left blank.) Each SF 215 must show the

following information:

The name of the bank on which the instrument

is drawn

The medium of exchange

The foreign currency amount

The date of the instrument

Upon collection of the instrument, Citibank will

enter the date and U.S. dollar amount on the SF 215 and

return the confirmed copy to the DO.

UNCOLLECTED

CHECKS

AND

COLLECTION CHARGES.— As mentioned

previously, Citibank may find some checks on foreign

banks to be uncollectible, It may also assess charges for

processing some of these instruments. The U.S.

Treasury has established a minimum amount per check,

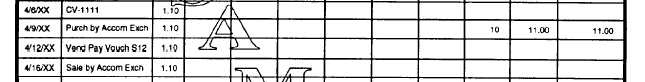

Figure 5-7.—Sample DD Form 2663, Foreign Currency Control Record (front).

5-12

|