| |

as valued in U.S. dollars. The value of each check must

be or exceed the established minimum amount before

Citibank will accept it for deposit. For checks from

Canadian banks, the minimum amount per check is

$5.00 (U.S. dollars). For checks drawn on banks in

other foreign countries, the minimum amount per check

is $15.00 (U.S. dollars). Sometimes, collection

charges, such as uncollectible check charges or

exchange fees, are incurred in connection with the

foreign checks. These charges are assessed and, after

dollar credit has been given to the Treasury, they are

charged back to the DO. The DO will receive an SF

5515 prepared by Citibank showing these chrages.

Upon receipt of the SF 5515 from Citibank, the DO

is responsible for collections. Exchange fees and other

collection charges are collectable from the person or

vendor who presented the instrument to the DO.

However, if collection cannot be made or is otherwise

impractical, the assessed charges are properly

chargeable to the disbursing activity’s operations and

maintenance funds. Any gain or loss as a result of a

difference in the dollar amount of the foreign currency

as carried by the DO and the rate of exchange when

processed by Citibank will be accounted for the same

as any other gain or loss on revaluation.

FOREIGN CURRENCY RECORDS

AND REPORTS

All transactions involving foreign currency are

treated as cash transactions and basically follow the

same principles and guidelines established for

controlling U.S. currency. However, disbursing

personnel involved in foreign currency are required to

maintain specific records.

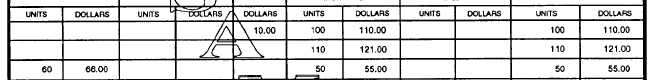

SUBSIDIARY RECORDS

All DOs, agents, or cashiers who engage in foreign

currency transactions are required to maintain a record

of those transactions on a DD Form 2663, Foreign

Currency Control Record. A sample DD 2663 is shown

in figures 5-7 and 5-8.

Figure 5-8.—Sample DD Form 2663, Foreign Currency Control Record (back).

5-13

|