| |

Upon Relief of a Disbursing Officer

Upon the relief of a DO, all funds-including those

in the hands of deputies and other accountable

assistants-must be transferred to the relieving DO. A

certificate of transfer should be furnished on the bottom

of the final Statement of Accountability, SF 1219, of the

officer relieved. The certificate shall read as follows:

I have received on (date) by transfer from

officer relieved), (total amount) an analysis of

which is included in Sections I-B and I-C

above.

(Signature and rank of relieving officer).

In addition to the normal distribution requirements,

two extra copies of the SF 1219 must be prepared. One

copy will be filed with the retained records of the

relieving officer the other copy will be retained by the

officer being relieved as a receipt for the funds

transferred. The original and all copies of the SF 1219

must be signed by both the officer relieved and the

relieving officer.

DEPOSIT OF EXCESS FUNDS

Funds received by DOs that are not currently

required for disbursing operations, including all checks

and other negotiable instruments, are considered to be

excess funds. Excess funds must be deposited for credit

to the Department of the Treasury. Excess funds in the

form of checks, drafts, and money orders payable in

U.S. dollars must be deposited to the account of the

Department of the Treasury with a Federal Reserve

bank (FRB) or branch or with a designated general

depositary.

Other requirements for the deposit of excess funds

will vary, depending on whether the disbursing

operation is ashore or afloat and located in a U.S. or

foreign territory.

Shore Stations

For a shore station, deposits must be made on a

daily basis whenever the amount is $1,000 or more. If

the amount is less than $1,000, the funds maybe held

until the amount reaches or exceeds $1,000. In all

cases, however, funds must be deposited by the last

banking day of each week, regardless of the amount

accumulated. The DOs of units located in the 50 United

States must deposit U.S. Treasury checks in the sum of

$5,000 or more with the nearest FRB or branch. DOs

located outside the 50 United States should deposit all

checks or excess funds with the general depositary they

normally use.

Ships Afloat

For the deposit of excess funds, the requirements

for DOs assigned to afloat units are slightly different

from those for DOs assigned to shore units. They even

differ according to whether the ship is in port or at sea.

SHIPS AT SEA.— When daily mail service is not

available, the DO of a ship at sea may accumulate up

to $5,000 in receipts before depositing them. (The

receipts must consist only of personal checks, money

orders, and other non-Treasury negotiable instruments.)

However, a deposit of all receipts on hand must be made

at least once each week. (Note: This exception

covering accumulated deposits up to $5,000 in receipts

does not apply to U.S. Treasury checks.)

The DO prepares the deposits for mailing via

registered mail and delivers them to the post office on

board. All deposits must be mailed to an FRB or a

branch. This means negotiable instruments to be

deposited are not to be held in the DO’s accountability

pending the ship’s arrival at the next scheduled port of

call. The DO must make a deposit on the last regular

business day before the ship leaves port and the first

regular business day after the ship returns to port for any

at-sea period in excess of 1 week. These deposits are

required regardless of the total amount involved, the

time interval since the last deposit, and the type of

checks and negotiable instruments on hand.

SHIPS IN U.S. PORTS.— For ships in U.S. ports,

deposits of excess funds must be either delivered in

person or sent via registered mail to the nearest FRB.

Deposits must be made when receipts accumulate to

$1,000 as prescribed for shore stations.

Deposit Procedures

All negotiable instruments must be endorsed before

deposit. The endorsement will depend on where the

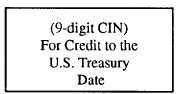

deposit is being made. Deposits to an FRB or a branch

must have a 9-digit Ca$h-Link Identification Number

(CIN), which is specific to each disbursing office. The

date will be the date of the bank’s business date on

which the deposit is made. Figures 1-1 and 1-2 show

sample endorsements.

Figure 1-1.-Sample endorsement for an FRB or branch.

1-21

|