| |

Make certain that all your reporting documents

are legible. Remember, you must send the signed

original and one copy of the Ship’s Store Balance

Sheet and Profit and Loss Statement (NAV-

COMPT 153) with the required substantiating

documents to the appropriate FAADC.

Make Up of Original (Forwarding)

and Retained Returns

When assembling and substantiating your

returns, you should make up both your retained

and forwarding returns together. This strategy will

allow you to double-check all figures on the

substantiating documents and to make certain you

have copies for both sets. When assembling your

returns, make two stacks and compile both as you

go along, making sure that both stacks contain

exactly what your NAVSUP P-487 requires.

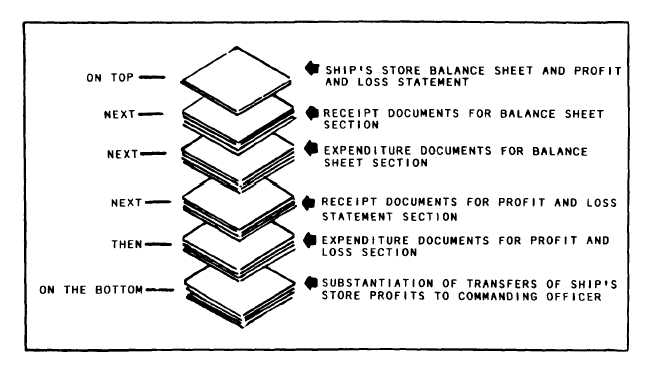

Table 7-1 was presented for your convenience.

Carefully read through the information in the

table. Follow the sequence given when you are

substantiating and assembling your ship’s store

returns.

As indicated in the table, all documents that

you include in the original (forwarding) returns

you will also include in the retained returns.

information in your retained returns. For

example, all documents in the accountability file

of the current accounting period that you did

not include in the original returns must be

included in the retained returns. Any list of

discrepancies, as required in NAVSUP P-487,

must also be placed in the retained returns.

However, do not file the ending inventories in the

current retained returns. Carry the ending inven-

tories forward into the accountability file of the

next accounting period.

Arrangement of Original and

Retained Returns

As indicated earlier, the original and

retained returns should be arranged in the same

order. Whether the returns are prepared for sub-

mission or for filing, the arrangement is always

the same.

The required documents that must be included

with the retained returns, but not submitted

with the original returns, should be filed at the

bottom of the retained returns. In the case of

large ships, these additional documents can be

maintained in a separate folder or box.

The arrangement you should use for all returns

However, you will need to include some additional

is shown below.

7-24

|